Once upon a time, the US Supreme Court decided to uphold the Citizens United case, allowing corporations and organizations -- including foreign entities -- to spend unlimited amounts of money in support or opposition to a candidate, without having to disclose where that money came from. It struck down a previous law banning this practice.

Once upon a time, the US Supreme Court decided to uphold the Citizens United case, allowing corporations and organizations -- including foreign entities -- to spend unlimited amounts of money in support or opposition to a candidate, without having to disclose where that money came from. It struck down a previous law banning this practice.The Supreme Court not only opened the floodgates allowing unlimited and unregulated corporate money to flow into campaigns, it also blurred the line between political groups and non-profit social welfare groups. Until then, these social welfare groups could only apply for tax-exempt status as "501(c)(4)" groups, with the strict privilege of not engaging in political speech. But now it's difficult to determine which social welfare groups live up to that standard. Certainly the Teabagger groups did not: they were completely political in nature.

So this Supreme Court ruling occured in 2010, and immediately afterward, over 3,000 rightwing groups that opposed President Obama sprang up like weeds and demanded to be recognized as non-profit, civic organizations that should be given tax-exempt status. The IRS noticed they all used the words "tea party" or "patriot." So they used those as search terms.

Because of this, it was determined the IRS "used inappropriate criteria that identified for review Tea Party and other organizations applying for tax-exempt status based upon their names or policy positions," as the complaint goes.

In other words, yeah, the IRS is supposed to determine which groups deserve tax-exempt status and which don't; they just can't use specific terms flagging rightwing groups.

So the IRS is now faced with the challenge of filtering out groups that step over the line and flagrantly abuse the social welfare moniker without appearing to specifically target rightwing Teabagger groups. See?

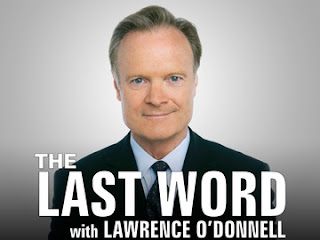

The real problem, as Lawrence O'Donnell clearly pointed out this week on his msnbc program, is that back in 1959, the IRS arbitrarily changed the word "exclusively" to "primarily" in this rule:

The real problem, as Lawrence O'Donnell clearly pointed out this week on his msnbc program, is that back in 1959, the IRS arbitrarily changed the word "exclusively" to "primarily" in this rule:Section 501(c)(4) of the Internal Revenue Code defines tax-exempt social welfare groups as: Civic leagues or organizations not organized for profit but operated exclusively for the promotion of social welfare.

In 1959, under the administration of Dwight Eisenhower, the meaning of this section was changed dramatically when the IRS decided the word “exclusively” could, in effect, be read as “primarily.”

“For 54 years, the IRS has gotten away with the crime of changing the word ‘exclusively’ to ‘primarily',” said Lawrence O’Donnell on The Last Word Monday. “The IRS took a hard, clear word like ‘exclusively’ and changed it into a soft word ’primarily’ and then left it to the IRS agents to determine if your organization was primarily concerned with the promotion of social welfare.”

This is why every Teabagger group was given tax-exempt status, despite the fact that they are not social welfare groups, but completely political in nature, which flies in the face of the IRS rule stated above.

The bottom line is that even though the IRS used rightwing-specific terms to search for these groups, not one was turned down for tax exempt status, even though they should have. And it wasn't an Obama appointee in charge during these years -- it was Douglas Shulman, appointed by George Dubya Bush.

No comments:

Post a Comment